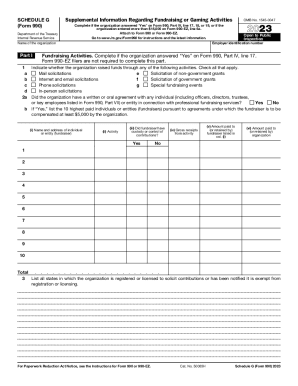

IRS 990 - Schedule G 2024-2026 free printable template

Instructions and Help about IRS 990 - Schedule G

How to edit IRS 990 - Schedule G

How to fill out IRS 990 - Schedule G

Latest updates to IRS 990 - Schedule G

All You Need to Know About IRS 990 - Schedule G

What is IRS 990 - Schedule G?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule G

What should I do if I discover an error after submitting IRS 990 - Schedule G?

If you find an error on your IRS 990 - Schedule G after submission, you need to file an amended return to correct it. Ensure that you clearly mark the amended form and include a detailed explanation of the errors made. Keeping accurate records of any amendments is crucial for compliance.

How can I verify the status of my submitted IRS 990 - Schedule G?

To verify the status of your IRS 990 - Schedule G submission, you can check the IRS 'Where’s My Return?' tool available on their website. Additionally, if e-filing, you may receive an acknowledgment via email with a status update, including any potential rejection codes.

What should I do if I receive an IRS notice regarding my Schedule G submission?

If you receive an IRS notice related to your IRS 990 - Schedule G, carefully read the notice for specifics. Generally, you may need to respond with additional documentation or clarification. It's important to meet any deadlines stated in the notice to avoid penalties.

What are the common errors to avoid when filing IRS 990 - Schedule G?

Common errors in filing the IRS 990 - Schedule G can include inaccurate reporting of compensation, not including required disclosures, or submitting incorrect totals. Double-checking the figures and ensuring all required parts are completed can help minimize these mistakes.

Are there any technical requirements for e-filing IRS 990 - Schedule G?

When e-filing your IRS 990 - Schedule G, ensure your software is compatible with the IRS e-file specifications. Additionally, use updated web browsers to avoid issues during submission. Following technical guidelines can help prevent errors and ensure successful filing.

See what our users say