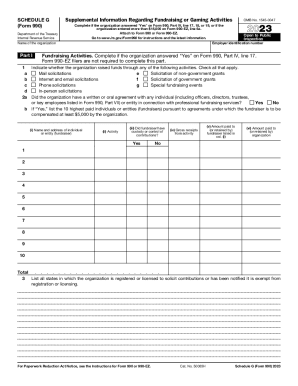

Who fills out tax form 990 or 990-EZ Schedule G?

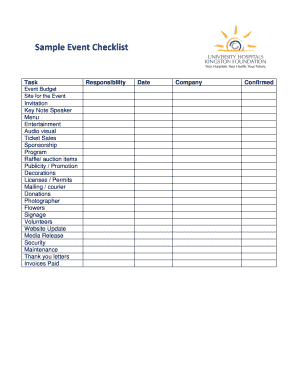

Schedule G is an attachment to the income returns 990 or 990-EZ, which are the filed by tax-exempt organizations. Not all organization have to attach Schedule G to the income return form; it is supposed to be completed by those who did any organizational fundraising via activities, events or gaming activities.

What is the purpose of Schedule G?

Schedule G is fully called Supplemental Information Regarding fundraising or gaming Activities. When completed, the form must deliver all relevant details concerning events and activities aiming to raise money.

The fundraising events include:

1. Publicizing and conducting fundraising campaigns

2. Conducting the fundraising events

3. Maintaining a donor mailing list

4. Professional fund-raising services

5. Conducting activities involved in soliciting contributions from the governments, individuals and foundations.

What other forms are needed when I file IRS 990 Schedule G form?

Schedule G must be filed along with the Information Return Form 990 or Form 990 EZ.

When is IRS 990 Schedule G due?

Since Schedule G is attached to Form 990 and Form 990 EZ, the deadline is correlated with the end of the organization’s fiscal year. The form should be filed at latest by the 15th day of the 5th month after the end of the year.

What information do I need to complete this form?

The 990 Schedule G needs the name of the organization and EIN. It also requires gross revenue and receipts from fundraising activities, fundraising events, and gaming. For more instructions on filling the form, consult the IRS instructions.

Where do I file IRS 990 Schedule G?

The Schedule G must be sent to the Internal Revenue Service center at the following address: Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0027.